How to calculate the employee’s net salary as well as net pro labore?

What are the company’s additional costs on the monthly remuneration of an employee and over a pro labore?

The deductions and additional costs are the same for both pro labore and employee?

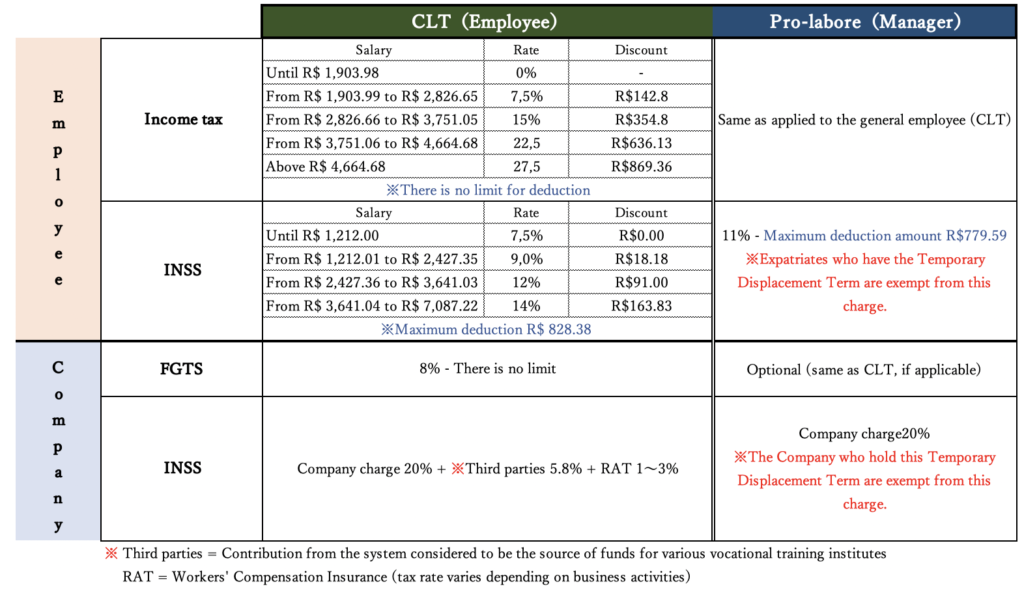

These are some of the most frequently asked questions we receive in our office and to help guide you through, we have created the table below:

① How to calculate the employee’s net salary as well as net pro labore?

For an employee who makes a gross monthly salary of R$5,000.00, the net salary will be:

( + ) Gross salary 5,000.00

( – ) INSS* 99.25

( – ) Income tax 478.35

( = ) Net Salary 4,422.41

In the case of pro labore, it will be:

( + ) Gross Pro labore 5,000.00

( – ) INSS* 550.00

( – ) Income tax 365.12

( = ) Net Pro labore 4,084.88

* for cases in which the expatriate has a valid Temporary Displacement Term, this value will be zero

② What are the company’s additional costs over the monthly remuneration of an employee and pro labore?

Taking as an example the data used in the simulation above, the additional expenses for the company would be:

A-Employee

INSS* between 26.8% ~ 28.8%

FGTS 8%

INSS* 5,000.00 X 26.8% (for example) = 1,340.00

FGTS 5,000.00 X 8% = 400.00

Total 1,740.00

B-Pro labore

INSS* 5,000.00 X 20% = 1,000.00

Total 1,000.00

* for cases in which the expatriate has a valid Temporary Displacement Term, this value will be zero

③ The deductions and additional costs are the same for both pro labore and employee?

No. As demonstrated in the examples above, both the deductions and the additional costs for the company are different for the cases of employees and pro labore.

It is important to highlight that employees, unlike pro labore, have the right to vacation and the 13th salary as well.