In Brazil, in addition to the tax obligations imposed by the tax authorities, there are still others that are required by the Brazilian Central Bank for companies and individuals as follow:

DEF – Economic and Financial Statement – ANNUAL/QUARTERLY

CENSO – Census of Foreign Capitals in the Country QUINQUENNIAL / ANNUAL

Update of the Foreign Investment Registry

CBE – Brazilian Capitals Abroad ANNUAL / QUARTERLY

PRACTICAL EXAMPLES

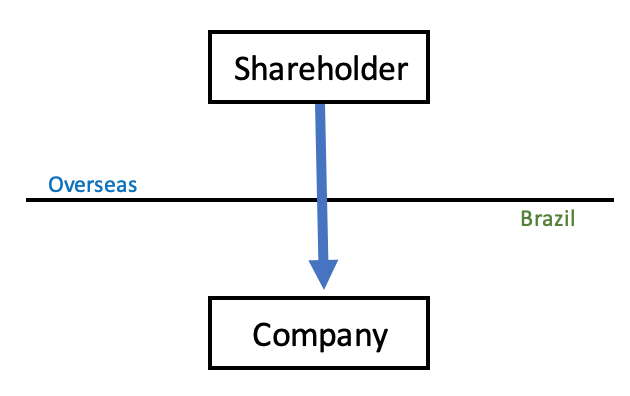

1.Companies that have foreign investors

A – DEF – Economic and Financial Statement – ANNUAL/QUARTERLY

A.1 – Annual

Companies that have foreign investors must annually declare to the Central Bank the statement called DEF regardless of the invested capital or Total Shareholders’ Equity.

In this statement, the corporate structure and economic / financial information of the company are provided.

A.2 – Quarterly

Companies that holds an Assets or Shareholders’ Equity equal to or greater than BRL 250,000,000.00 (Two Hundred and Fifty million Reais) regardless of the capital invested, must declare the DEF quarterly, observing the following schedule: I – until June 30, concerning the database from March 31; II – until September 30, concerning the database from June 30; III – until December 31, concerning the database from September 30; and IV – until March 31 of the following year, concerning the database from December 31.

B – CENSO – Census of Foreign Capitals in the Country QUINQUENNIAL / ANNUAL

B.1 – Quinquennial

Every 5 years such companies need to declare the CENSO to the Central Bank in the years ending in 0 and 5.

In these statements are informed the company’s financial information.

The base date of the information is 12/31 of the previous year and the deadline from last year was on 08/16.

Legal entities headquartered in Brazil, regardless of their corporate structure, with a total outstanding balance of short-term commercial credits (payable within 360 days) granted by non-residents equal to or greater than the equivalent of US$1,000,000.00 (Ten million US dollars) on December 31 of the base year must also submit the Quinquennial Census.

B.2 – Annual

The Annual Census must be presented by the following companies:

- legal entities headquartered in the country, with direct participation of non-residents in their capital stock, in any amount, and with shareholders’ equity equal to or greater than the equivalent of US$100,000,000.00 (One Hundred Million United States Dollars), on 31 December of the base year;

- investment funds with non-resident shareholders and shareholders’ equity equal to or greater than the equivalent of US$100,000,000.00 (One Hundred Million United States Dollars), as of December 31 of the base year, through their managers; and

- legal entities headquartered in Brazil, regardless of their corporate structure, with a total outstanding balance of short-term commercial credits (payable within 360 days) granted by non-residents equal to or greater than the equivalent of US$10,000,000.00 (Ten Million United States Dollars) on December 31 of the base year.

C – Update of the Foreign Investment Registry

The Brazilian company that receives foreign investments must keep the value of its net equity and paid-in capital stock updated in the Direct Investment Registry, including detailed by each foreign investor. The update must be carried out within thirty days, counting from the date of occurrence of the event that changes the capital’s share of the foreign investor.

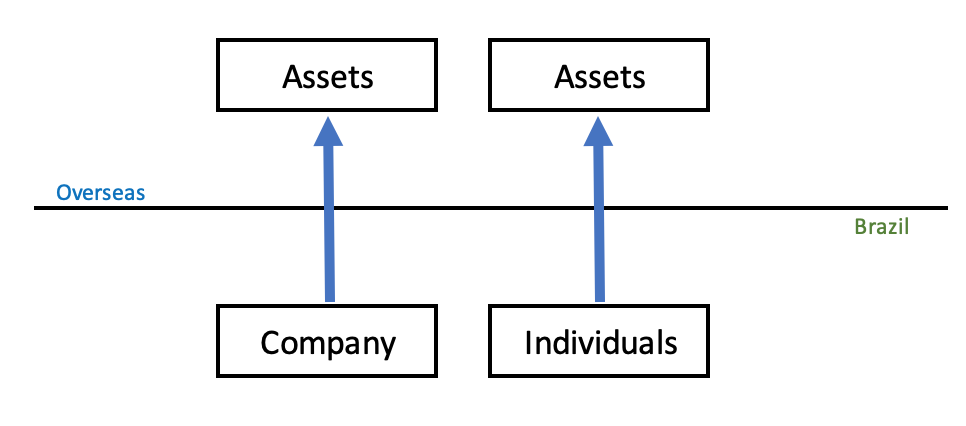

2-Companies and Individuals that have Brazilian Capital Abroad

A – CBE – Brazilian Capitals Abroad ANNUAL / QUARTERLY

A.1 – Annual

Individuals and legal entities residing in the country holding assets (assets and rights) abroad (including real estate, deposits, cash in foreign currency, among other assets) totaling an amount equal to or above US$1,000,000.00 (One Million United States Dollars) on December 31 of each year is required to file the annual CBE statement.

A.2 – Quarterly

Companies and individuals whose sum of all their assets and rights comprise an amount equal to or greater than US$100,000,000.00 (One Hundred Million United States Dollars) shall quarterly declare the list of these assets to the Central Bank called the quarterly CBE.

NOTE

The obligations listed above were based on a general overview from our clients.

Other financial activities such as investment funds, financial institutions or any other situations and activities that require special attention are not covered.

The deadlines may change.

In case of doubt, we are available for further clarification.

MAIN DOUBTS

Do I need to pay taxes by declaring all my overseas assets to Brazilian Central Bank?

No. The individual or company will not pay tax for the simple fact of having declared their assets in the CBE.

Do I need to file the CBE declaration only if an asset exceeds USD100 million?

No. You need to consider the sum of all your assets and not the isolated value of a single asset.

Are there penalties if you do not comply with any of the obligations required by the Brazilian Central Bank?

Yes, missing statement, false information or incorrect data may be subject to fines.

In addition to being subject to penalties, in the event of any pending issues, the company/individual may not complete transactions subject to registration with the Brazilian Central Bank.